Free Case Evaluation

Council & Associates LLC

Personal Injury Lawyers in Atlanta GA

Your Atlanta Car Accident Attorneys

At The Council Firm, we understand the challenges and complexities that come with car accident claims. With years of experience and a deep understanding of Georgia's personal injury laws, our team of dedicated attorneys is committed to helping accident victims seek the justice and compensation they deserve. We strive to provide personalized and compassionate legal representation to clients in Atlanta and the surrounding areas. On our site, you'll find detailed information about our legal services, our team of experienced lawyers, and our approach to handling car accident cases. We believe in the power of knowledge and transparency, which is why we provide educational resources and FAQs to help you better understand your rights and the legal process.

Why choose The Council Firm for your Atlanta car accident claim

- When you choose The Council Firm, you can expect diligent and thorough representation. We investigate every aspect of your case, gathering evidence, speaking with witnesses, and consulting with experts if necessary. Our goal is to build a strong and persuasive case on your behalf, whether it involves negotiating with insurance companies or advocating for you in court.

- We understand that car accidents can result in severe injuries, property damage, and emotional trauma. Medical bills, lost wages, and ongoing treatment expenses can quickly add up, placing a significant financial burden on you and your family. Our car accident lawyers are well-versed in calculating the full extent of your damages, including both economic and non-economic losses, to ensure you receive fair compensation for your pain and suffering.

- At The Council Firm, we prioritize open communication and client satisfaction. We strive to be accessible to our clients, providing regular updates on the progress of their cases and promptly responding to any inquiries or concerns they may have. Our ultimate objective is to guide you through the legal process, alleviate your stress, and achieve the best possible outcome in your car accident claim.

Automobile accidents can happen in a blink of an eye -- simply put, a momentary lapse of judgement by another driver can result in substantial medical expenses, long recovery, and financial difficulties for a car accident victim. Fortunately, Georgia law allows car accident victims to pursue legal action against the at-fault party to recoup those financial losses. Call The Council Firm for specific legal assistance for your particular case.,

What are the critical components of a car accident claim

Evidence of Injuries

One of the most critical factors in a car accident case is proving that the victim has sustained injuries and that those injuries occurred in the accident. This is why it is so important for anyone who has been involved in a crash to seek medical attention, even if they do not believe they have been injured or their injuries were minor. All medical documents that a victim receives at their first appointment – and subsequent appointments – should be saved and given to the Atlanta car accident lawyer representing them. This includes tests, diagnoses, surgeries, hospital stays, physical therapy, and more.

Determining Fault

In any personal injury claim, it must be determined who the at-fault party is. This is also true for car accident claims. In order to pursue a case against someone, the victim must show that the party’s negligent or reckless action or behavior caused the accident that resulted in their injuries and subsequent losses. An attorney will use a variety of ways to prove fault, including police reports, witness statements, and accident reconstruction experts.

Filing the Correct Documents

The first step in pursuing a car accident claim is to file a claim with the other party’s insurance company. Once this is done, your lawyer will likely engage in negotiations with the insurance company in trying to reach a fair settlement amount. If the insurance company fails to negotiate in good faith or denies the claim completely, your lawyer will then file a car accident lawsuit petition with the court that holds jurisdiction over the location where the crash occurred. If the case does go to trial, both sides will present their sides and a jury will decide if and how much compensation the victim deserves.

Statute of Limitations

Another critical issue to remember is that Georgia does have a statute of limitation for how long a victim has to file a car accident case. If the claim is not filed within two years of the accident, the victim loses their right to pursue any damages, regardless of who was at fault.

What you MUST do if you are at the scene of a car accident in Atlanta:

Being involved in a car accident can be a chaotic and overwhelming experience. If you find yourself in a car accident in Atlanta, it's crucial to remain calm and take the appropriate steps to ensure your safety and protect your legal rights. Here's what you should do at the scene of a car accident in Atlanta:

Prioritize Safety

First and foremost, ensure your safety and the safety of others involved. Move your vehicle to a safe location, if possible, and turn on hazard lights. If there are injuries or significant damage, call 911 immediately to report the accident and request medical assistance.

Gather Information

Exchange information with the other parties involved in the accident. This includes names, contact details, driver's license numbers, license plate numbers, insurance information, and vehicle descriptions. It's also helpful to collect contact information from any witnesses present at the scene.

Document the Scene

Take photos or videos of the accident scene, including the positions of the vehicles, any visible damages, and relevant road conditions. These visual records can serve as valuable evidence later when filing an insurance claim or pursuing a legal case.

Contact the Police

In Atlanta, it's important to contact the police and report the accident, especially if there are injuries, significant property damage, or disputes between parties. The police report can provide an official record of the incident, which can be essential for insurance purposes and potential legal proceedings.

Seek Medical Attention

Even if you don't feel immediate pain or injuries, it's advisable to seek medical attention as soon as possible. Some injuries may not manifest symptoms right away, and a medical evaluation can help identify and document any injuries sustained in the accident.

Notify Your Insurance Company

Promptly notify your insurance company about the accident. Provide them with accurate and detailed information about the incident. Be cautious when discussing the accident with the other party's insurance company and avoid admitting fault or making statements that may be used against you later.

Consult with a Car Accident Lawyer

Consider consulting with a reputable car accident lawyer in Atlanta. They can guide you through the legal process, protect your rights, and help you navigate insurance claims or pursue legal action if necessary.

Remember, every accident is unique, and the specific actions you should take may vary based on the circumstances. It's always advisable to consult with a legal professional to ensure you are taking the appropriate steps and to understand your rights and options following a car accident in Atlanta.

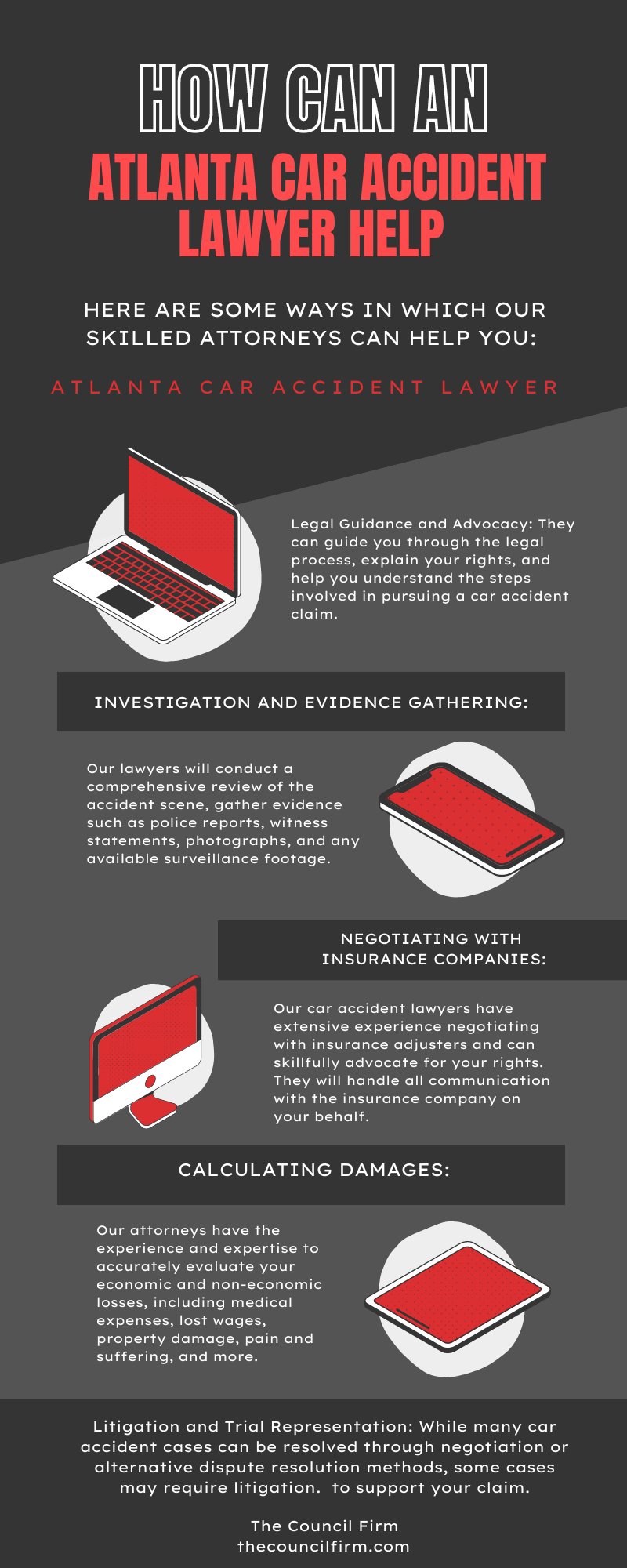

Atlanta Car Accident Law Infographic

How is compensation determined for Atlanta, GA car accidents

Economic Damages

Economic damages refer to the tangible financial losses resulting from the accident. This may include medical expenses, rehabilitation costs, property damage, lost wages, and future medical expenses or loss of earning capacity. These damages are typically easier to calculate, as they are based on actual expenses or documented financial losses.

Non-Economic Damages

Non-economic damages are more subjective and cover the intangible losses suffered by the injured party. These may include pain and suffering, emotional distress, loss of consortium, loss of enjoyment of life, and scarring or disfigurement. Calculating non-economic damages often involves factors such as the severity of the injury, its impact on the individual's daily life, and the prognosis for recovery.

Comparative Fault

Georgia follows a modified comparative fault rule. This means that if the injured party is found partially responsible for the accident, their compensation may be reduced by their percentage of fault. However, as long as the injured party is less than 50% at fault, they can still seek compensation for their damages.

Insurance Coverage

Georgia requires drivers to carry minimum liability insurance coverage, which includes bodily injury liability and property damage liability. In car accident claims, compensation may come from the at-fault driver's insurance coverage. However, if the at-fault driver is uninsured or underinsured, the injured party may also be able to seek compensation through their own uninsured/underinsured motorist coverage.

Legal Representation

Working with an experienced car accident lawyer in Atlanta is crucial to navigating the complexities of determining damages and pursuing fair compensation. A skilled attorney can assess the full extent of your damages, gather evidence, negotiate with insurance companies, and, if necessary, advocate for you in court.

It's important to note that each car accident case is unique, and the specific damages and compensation awarded can vary widely based on the individual circumstances. Consulting with a knowledgeable car accident lawyer in Atlanta can help ensure that you understand your rights, accurately evaluate your damages, and pursue the maximum compensation available in your case.

What are the most common types of car accidents in Atlanta, GA?

If you are working with ta, GA car accident lawyer, then you are already familiar with one type of car accident. However, it is important to know the most common car accident types in case of emergency. This is good information for you or a loved one to know. If you have just been in an accident and are in need of help, contact Council & Associates, LLC today.

Rear-End Collision

This is the most common accident to occur. It can happen just about anywhere and have multiple causes. From stoplights to highways and distracted driving to slick roads, rear-end collisions happen on a daily basis throughout the United States. Chances are, if you have been in an accident, it is a rear-end collision. Most of the time these accidents are not overly harmful, but sometimes they can be quite severe, causing passengers to need medical aid. Even in the most benign circumstances, a person can suffer whiplash which can lead to more issues down the line such as spinal problems.

T-bone

If a car hits your car at a perpendicular angle, this is called a t-bone accident because the two cars form the shape of a t. This most commonly happens at intersections, and these types of accidents are generally severe. Both cars involved will take damage, and passengers in both vehicles will suffer various injuries. Generally, the car that is t-boned suffers the most injuries — meaning the car that is hit in the middle. T-bone accidents occur from things such as running red lights to drivers not yielding as they should.

Roll-over

These are extremely severe accidents and tend to be very rare compared to the other types mentioned thus far. A roll-over is exactly what it sounds like: your car rolls over. Either your car is hit at just the right angle and speed, causing it to slip over, or your car is hit on slick roadways, causing it to flip. Even if the weather is bad and contributed to your accident, you can still work with an Atlanta car accident lawyer to pursue compensation for the other negligent driver involved.

Head-On Collision

A head-on collision can refer to two different types of accidents: an accident where two vehicles run directly into each other, or when one vehicle runs straight into something else other than another car such as a road block. If another person hits your car head-on, then you are eligible to pursue compensation. If something falls into your path or is not being safely maintained and marked, then you can still pursue compensation of the person that the obstruction belongs to; for example, if a person does not tie down furniture securely in the back of their vehicle and it comes loose, causing a head-on collision with your vehicle, you can still sue them.

Sideswipes

While these might be confused with t-bones, the two are actually very different. A sideswipe occurs when the side of someone’s car runs into your car. For example, if you are both turning onto a road, a person may drive past you and sideswipe your car. These can also range from severe to mild. They are most likely to occur during lane changes.

Roads That Have Been Known For Accidents In Atlanta

There are several roads in Atlanta that have historically experienced higher accident rates. These roads often have heavy traffic congestion, complex intersections, and other factors that contribute to increased accident risks. Some of the roads that have been known for accidents in Atlanta include:

- I-285 (Perimeter Highway): As one of the busiest highways in Atlanta, I-285, also known as the Perimeter Highway, is prone to congestion and accidents. The high volume of traffic, multiple interchanges, and various merging points make it a challenging road to navigate safely.

- I-85: Another major interstate highway in Atlanta, I-85, experiences heavy traffic flow and a significant number of accidents. This highway runs through the heart of the city and connects with major interchanges, resulting in increased collision risks.

- I-75: I-75 is a busy interstate that runs north-south through Atlanta. It intersects with I-85 and passes through heavily populated areas, leading to frequent traffic congestion and a higher likelihood of accidents.

- Peachtree Street: Peachtree Street is a major road in Atlanta, known for its heavy traffic and complex intersections. It spans across the city and is lined with numerous businesses, making it susceptible to accidents, especially during peak commuting hours.

- Buford Highway: Buford Highway is a multi-lane road that connects Atlanta with its northern suburbs. It is known for its high traffic volume and diverse mix of vehicles, including pedestrians and cyclists. The combination of heavy traffic, numerous driveways, and varying speeds can contribute to accidents along this road.

It is essential to remember that accident risks can exist on any road, and safe driving practices, adherence to traffic laws, and staying alert are crucial regardless of the specific road you are traveling on in Atlanta or any other area. It's always advisable to stay informed about current road conditions, be cautious while driving, and take appropriate measures to prevent accidents.

Why Choose Council & Associates, LLC for Your Personal Injury Case?

Accidents can happen in the blink of an eye, forever changing lives. When you or a loved one suffers injuries due to a motor vehicle accident, having seasoned accident attorneys to navigate the legal maze is vital. Council & Associates, LLC stands at the forefront of legal representation, ensuring that personal injury accident victims are comprehensively supported and protected.

One key principle in personal injury law is the "duty of care." Every driver owes a duty to act with caution and consideration on the roads. When this duty is breached, and injuries result, an auto accident attorney from our Law Firm can help establish liability and pursue rightful compensation.

Another fundamental doctrine is "comparative fault." This rule considers the degree to which each party is at fault for the accident. With Council & Associates, LLC by your side, you're equipped with the expertise to ensure you're not unfairly blamed or short-changed by insurance adjusters who might seek to minimize their payouts.

Navigating the aftermath of a motor vehicle accident can be overwhelming. From dealing with insurance policy nuances to ensuring you receive the necessary medical care, there's a lot to manage. Our personal injury lawyer team can take on insurance companies, ensuring that you aren't taken advantage of during this vulnerable time.

Our dedicated team consists of not only the best personal injury attorney professionals but also specialists in areas such as wrongful death. If the worst should happen, you can trust Council & Associates, LLC to pursue justice for your loved one.

Whether you need an auto accident lawyer to litigate on your behalf or an injury lawyer to negotiate with an insurance adjuster, Council & Associates, LLC is the trusted choice. We are committed to fighting for the maximum financial compensation you're entitled to, ensuring that medical care, lost wages, and other damages are covered.

In choosing Council & Associates, LLC, you're choosing expertise, dedication, and a personal commitment to your case. Trust us to be the ally you need in your pursuit of justice.

Atlanta Car Accident Statistics

According to the National Safety Council, car accidents are the leading cause of personal injury in the United States. In 2021, there were over 6 million car accidents in the United States, resulting in over 3 million injuries and 40,000 fatalities. Drunk driving and speeding are two of the most common causes of fatal car accidents.

If you have been injured in a crash caused by another party, makes sure you have a dedicated car accident lawyer advocating for you to ensure you get the financial compensation you may be entitled to.

Atlanta Car Accident Law FAQs

Car accidents are often stressful and can leave individuals feeling overwhelmed. It's common to have questions about car accident law and how an Atlanta, GA car accident lawyer from Council & Associates, LLC can help. In this article, we will address five frequently asked questions to provide a better understanding of car accident law and the ways car accident lawyers can assist you after being in an accident.

What Should I Do If I've Been Injured?

If you or a loved one has been injured in an accident, there are a few steps you can take to ensure you receive the compensation you deserve. First, it's important that you seek medical attention as soon as possible. Next, gather any evidence you can from the scene of the accident, including photos, witnesses' contact information, and your own insurance information. Then, contact a car accident lawyer in Atlanta who can help you build a case and get the compensation you need. An attorney may be able to do this through negotiation with the other party, but they may also have to file a lawsuit against them. It's always best to consult with a professional before taking any legal action on your own.

What Is The Definition of Negligence?

The legal definition of negligence is when someone fails to use reasonable care and causes an injury or damage as a result. In order for someone to be held liable for your injuries, your actions must have fallen below the standard of care that a reasonable person would have used in the same situation.

There are four main elements to negligence: duty, breach, causation, and damages. The first step in proving negligence is showing that the defendant had a duty to exercise care toward you. For example, all drivers have a duty to operate their vehicles safely. Once it’s been established that the defendant had a duty of care towards you, it must then be proven that they breached this duty. A breach can either be intentional or unintentional, but there needs to be proof that the party was careless. It's not enough for there to simply be proof that the driver made a mistake; he/she has to have shown deliberate disregard for safety in order to be found negligent. Finally, it needs to be shown that the defendant's actions caused harm and resulted in some kind of injury (physical or emotional). Depending on what happened during the accident and how badly you were hurt, it may not always seem obvious what kind of evidence will support your claim (e.g., black-and-white photographs versus doctor's records) which is why you need a car accident lawyer to represent you.

What should I do immediately after a car accident?

After a car accident, your first priority should be safety. Ensure that everyone involved is safe and seek medical attention for any injuries. It's also crucial to gather information such as the names, contact details, and insurance information of all parties involved. Document the accident scene by taking photographs of the damage to vehicles and any relevant road conditions. Additionally, report the accident to the local authorities or police.

When should I consult a car accident lawyer?

It is advisable to consult a car accident lawyer as soon as possible, especially if any of the following situations apply:

- Serious injuries: If you or anyone else involved in the accident has suffered severe injuries, a car accident lawyer can help protect your rights and ensure you receive fair compensation for medical expenses and other damages.

- Disputed liability: If there is a dispute regarding who was at fault for the accident, a car accident lawyer can gather evidence, analyze the circumstances, and build a strong case on your behalf.

- Insurance company disputes: If you encounter difficulties or delays in receiving fair compensation from insurance companies, a car accident lawyer can negotiate with the insurers and handle the legal aspects of your claim.

- Complex legal procedures: Car accident cases can involve intricate legal procedures and deadlines. An experienced car accident lawyer can guide you through the process, ensuring that you meet all necessary requirements and deadlines.

How can a car accident lawyer help me?

We can provide valuable assistance in various ways:

- Legal representation: Our Atlanta car accident lawyer can be your advocate throughout the legal process, representing your interests and fighting for fair compensation.

- Case evaluation: A lawyer will evaluate the details of your case, including evidence, medical records, and accident reports, to determine the strength of your claim.

- Negotiations: A car accident lawyer will negotiate with insurance companies on your behalf to secure a fair settlement that covers medical expenses, lost wages, property damage, and other damages.

- Gathering evidence: Lawyers have the resources and expertise to gather evidence such as accident reconstruction reports, witness statements, and expert opinions to strengthen your case.

- Trial representation: If a fair settlement cannot be reached through negotiation, a car accident lawyer can represent you in court, presenting your case before a judge or jury.

How long do I have to file a car accident claim?

The timeframe for filing a car accident claim, known as the statute of limitations, varies depending on your jurisdiction. It is essential to consult a car accident lawyer promptly to ensure you meet the applicable deadline. Failing to file within the specified timeframe may result in the loss of your right to seek compensation.

How much does a car accident lawyer cost?

Most car accident lawyers work on a contingency fee basis. This means they only get paid if they win your case and secure compensation for you. The fee is typically a percentage of the settlement or court award. Before hiring a lawyer, it's essential to discuss their fee structure and any additional costs or expenses that may arise during the legal process.

Car accidents can be traumatic experiences, but understanding car accident law and the role of a car accident lawyer can provide you with the necessary guidance and support. By consulting with an Atlanta car accident lawyer from Council & Associates, LLC, you can navigate complex legal procedures, protect your rights, and increase your chances of receiving fair compensation for your injuries and damages. If you've been in a car accident, don't hesitate to reach out

What evidence is needed to handle my car accident case?

As a car accident lawyer Atlanta, GA victims trust at Council & Associates, LLC may review with you, the more evidence you have, the better. Examples of useful evidence include photographs of your injuries, video showing the entire scene, witness statements, copy of police report, medical documentation for injuries, earning statements or used PTO/vacation hours, and other ways you experienced financial loss. If you do not have evidence except for your verbal testimony, then it will be your word against the other driver’s. Your lawyer can evaluate your case and suggest which types of evidence will be most influential.

How can I maximize how much I get in compensation?

During the time that your claim is being handled, try to refrain from using social media. Even if your account is private and only certain people can view what you post, there are ways that the opposition can access this information anyway and then use it against you. For instance, if you claim that you broke your leg and you are unable to work because of a car accident, then you should not post that you visited an amusement park shortly after that. Do not post anything on your social media that could be misinterpreted and then used to reduce or deny your claim.

Why am I being blamed for the accident?

Insurance companies are for-profit, which means they are for making themselves money, not spending it on victims who deserve compensation. The insurance company for the other driver involved may try to blame you for the car accident, despite it being obvious that you were not responsible. The tactics insurance companies use to avoid paying money to victims can lack integrity and truth. Your Atlanta car accident lawyer can intervene and protect your best interests if you are being blamed for an accident that wasn’t your fault.

Who is going to pay for my medical bills from the accident?

If you accrued medical bills for your accident injuries, then you may be owed restitution through your insurance company or a civil lawsuit. At our law firm, we firmly believe that victims of personal injury accidents should not have to pay money for losses that they faced due to another’s negligence or recklessness. If you are concerned that you won’t be able to afford your medical bills, rest assured that we can ensure you not only get the care you need, but that you are compensated fairly for all you have been through.

When is the best time to speak with a lawyer?

Many people may not automatically think to talk with a lawyer after being in an accident. We are often told what to do when an accident happens, but not how to protect ourselves from further financial hardship. We may be the victims in a crash and accept a settlement from our insurance not realizing that we are owed so much more. Your own insurance company may still try to reduce your claim and trick you into accepting a settlement offer that barely covers your total loss. So the best time to speak with an Atlanta car accident lawyer is as soon after the accident as possible. We can advocate for you and protect you from insurance companies and other parties who don’t have your best interest in mind.

Atlanta Car Accident Statistics

Auto accidents are the cause of many injuries and deaths throughout the state of Georgia. According to the Georgia Department of Transportation, Georgia is among the states leading the country in serious auto and truck accidents with more than 300,000 car, truck and motorcycle accidents reported last year. In most accidents, at least one negligent driver is usually at fault.

Georgia is among the states leading the country in serious auto and truck accidents with more than 300,000 car, truck and motorcycle accidents reported last year.

Council & Associated LLC Atlanta Car Accident Lawyer

50 Hurt Plaza, SE Suite 740 Atlanta, Georgia 30303

Personal injury cases are primarily handled on a contingency fee basis. We only collect fees once you are compensated for the hardship that you have endured. When you have to make critical decisions about filing insurance claims, we work hard to make sure the insurer pays the maximum amount of compensation that you deserve. Therefore, if you are injured in a car, truck or motorcycle accident, experienced Atlanta and Albany auto accident attorney Lashonda Council Rogers of Council & Associates, LLC can help. Our team has successfully represented countless auto accident victims throughout Georgia. At Council & Associates, LLC, we understand that being in a car, truck or motorcycle accident is traumatic. We know the life-changing effects a catastrophic injury can have on the injured individual and their family. That is why we are dedicated to helping you achieve the best outcome possible at trial or through settlement. For a confidential consultation, call (404) 526-8857. Let Us Fight For You! Free Consultation.

FREE CASE EVALUATION

PRACTICE AREAS

Client Review

“The Council & Associates team are amazing they kept me informed through the whole process. updates and time line was never an issue. I know my case wasn’t a million dollar case, but they made sure I was treated fairly would definitely use them again.”

Kenneth Boggs

Council & Associates, LLC

50 Hurt Plaza, SE Suite 740

Atlanta, Georgia 30303

OVER 200+ 5 GOOGLE REVIEWS

WHAT OUR CLIENTS SAY ABOUT US

Council & Associates, LLC 2024 © Powered by Matador Solutions - Sitemap